Social Security Must Be Kept Intact, Not Privatized

My Grandma Minnie Hansen was a happy, loving person. Widowed at 64, she lived alone in her little house on Cedar Street in Coleridge NE (pop 600). Grandma enjoyed church on Sundays and card games with her grandchildren and great-grandchildren until she died — peacefully — at the age of 93. The family helped out Minnie here and there, but for the most part she lived independently thanks to one of the most successful domestic policies in American history, the Social Security Act.

This Thursday, August 14, the Social Security Act turns 79. I hope all Americans– young and old – join me in celebrating our commitment to caring for one another across the generations. Still younger than Grandma Minnie, and still taking care of millions of Americans like her.

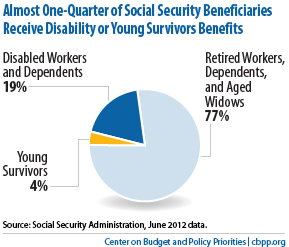

Without Social Security, Grandma Minnie would have lived in poverty. With it she did not. Today, a little over 8% of all American women live in poverty. Without Social Security, that number would soar to nearly 44%!

How Social Security Works

Social security collects a portion of workers’ current incomes, and then uses it to pay modest benefits to retirees. My income helps to provide for my elders; my children and grandchildren’s income will help to provide for mine.

Social Security is not an investment plan, like an IRA or a 401k. Individual Americans do not invest in Social Security in the hopes of receiving a payout later. Instead, the funds you and I contribute today are paid out immediately to current retirees. When the time comes for us to retire, we’ll benefit from the contributions that our children and grandchildren make. Our Social Security system is dependent on ongoing collections, not financial return on invested funds or even accumulation of contributions.

Some people, including my opponent, Ben Sasse, object to the structure of the Social Security system. Sasse wants Wall Street bankers to manage Social Security. I do not. Sasse describes the Social Security program as “generational theft.” But theft has nothing to do with it.

It’s not generational theft when you provide food and shelter for your children. Nor is it generational theft when you provide care for an aging parent. We take care of others out appreciation for the things they’ve done and will do for us. But we also take care of others out of love. That’s not theft — it’s the Golden Rule.

Sasse and other extremists want to dismantle the Social Security system by privatizing it. Doing so is both unethical and unnecessary. Defenders of Social Security, including me, cherish it for its stability, reliability, and its promise to those who have planned their lives assuming that Social Security is as dependable as the United States itself.

Once the United States makes a promise, it must keep the promise.

Social Security Challenges

After helping generations of Americans enjoy a secure retirement, our Social Security system faces two sets of challenges. The first is due to bad economic decisions brought about by bankers and short-cited politicians in the recent past. The second is due to a much happier set of circumstances – our nation’s triumphs in world war and medicine. Let’s look at both.

Bad Bankers & Bad Policy

Until 2010, our Social Security system always took in more than it paid out. This is how it should work in a stable nation with a growing population and economy to match. Thanks to reckless policy-making over the last several years, unemployment is up and interest rates are down. As a result, the system is bringing in less money and earning less on it than it has in the past.

Now, Washington is largely to blame for this unemployment problem. In an attempt to curry favor with corporate lobbyists, Congress created tax benefits that reward big corporations for moving jobs overseas. This means fewer American jobs; slumping payrolls; and declining deposits to Social Security.

When the housing bubble burst, it took with it even more American jobs. At the same time, interest rates collapsed. This meant earning power of money in the Social Security system fell.

Wall Street and its irresponsible banking practices played a central role in every part of this story — the housing bubble, the interest rate free-fall, and the jobs expatriation. When these reckless banks faced failure, our nation bailed them out. Doing so left us with huge national debt and more political pressure to keep the foolish laws that caused these problems to begin with. The most important thing we can do to help protect Social Security for future generations is to unwind these corrupt policies and get America working again.

The last thing we should do is turn Social Security over to Wall Street. The cost of operating Social Security is well under 1% of revenues. This is a huge bargain! Wall Street Mutual Funds average costs 7 or 8 times as much. Turning America’s most successful domestic program over to Wall Street would be nothing short of foolish.

The Baby Boom and Longer Lives

But keeping Social Security solvent will take some common sense effort, thanks to two very positive developments in human history:

First, we won World War II. 60 years ago, when our GIs came home, we had a baby boom. As those victory babies age toward retirement, they — we — undeniably create a strain on the social security system.

Second, most of us are living longer. Back when FDR created social security, the average American could expect to live to 60. These days, life expectancy is approaching 80. Longer lives are undeniably a good thing, but they mean longer retirements and more social security expenditures.

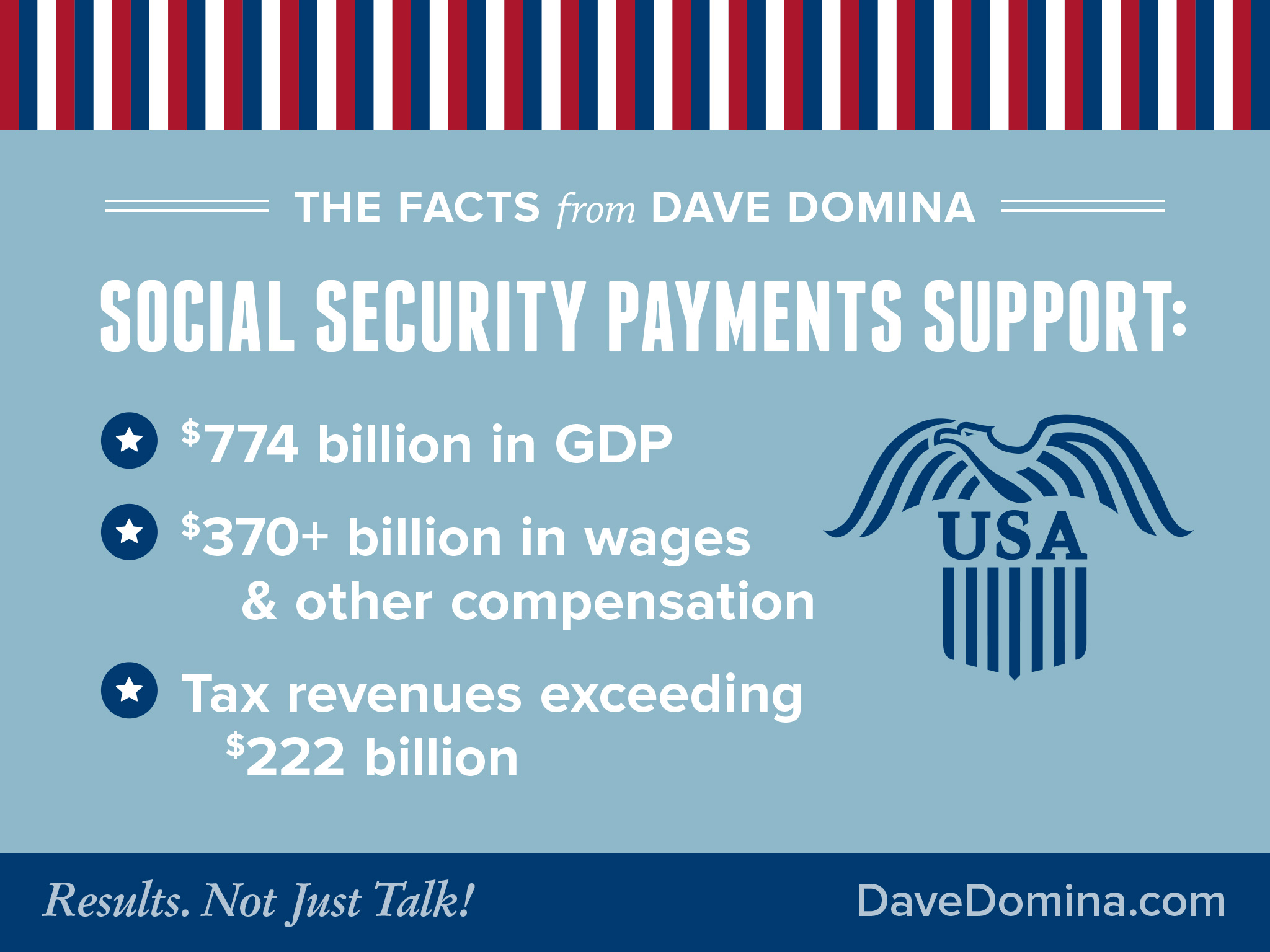

The Social Security system has more retirees to support than it has in the past. The sooner we reform the Social Security system to account for this, the better. To balance the books on Social Security, we’re going to need to take in more revenue – the best way to do this is repatriate jobs by ending tax and trade policies that encourage the movement of jobs out of the United States.

A few short years ago, we started to tax Social Security benefits. When that happened, benefits were effectively, and significantly, reduced, and the taxes paid were sent to the general treasury, and taken from the trust fund. This action could be modified so taxes on Social Security income are paid to the Trust Fund, not the general treasury. This solution, along with a gradual actuarial adjustment, made well in advance so as to not disrupt life plans, provide two different, workable modifications that assure the Social Security System’s safety for years to come.

We Can Do This!

As our Social Security system nears its 79th birthday, it’s time to reconfirm our commitment to looking after all Americans as they advance into retirement. To do so, we must put aside radical rhetoric about “generational theft.” With focused and reasonable leadership, we can bring Social Security through the 21st Century and beyond.

Ours is a country that can win world wars, travel immeasurable distances, and innovate to extend the human lifespan. Some in Washington think we can’t afford to enjoy the benefits of those great American accomplishments. They’re wrong.