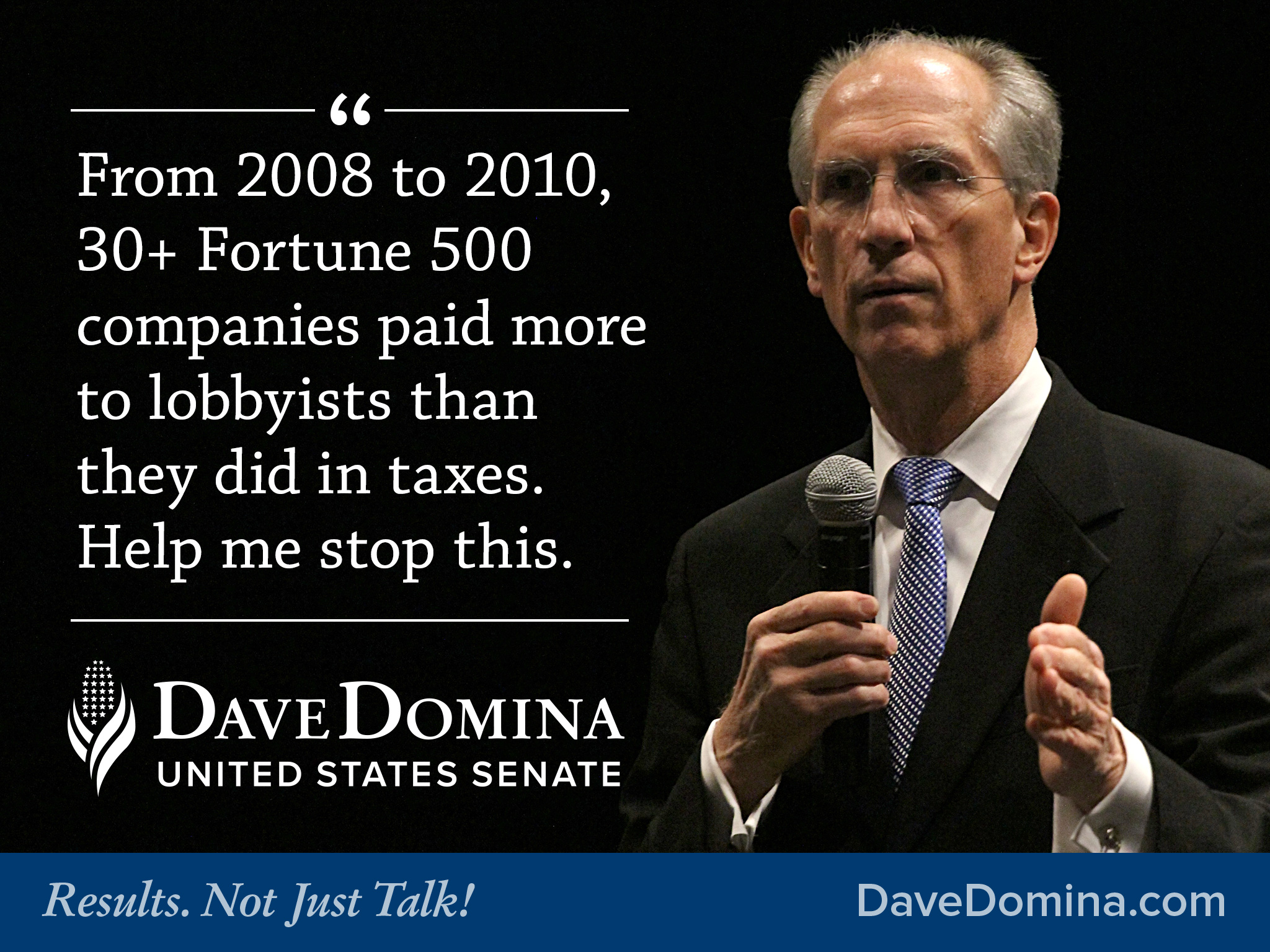

Domina: Tax Loopholes Create ‘Corporate Deserters’

Norfolk Daily News – Michael Avok

“Corporate deserters” are taking trillions of dollars per year from U.S. taxpayers, said David Domina, a candidate for the U.S. Senate.

And the federal government is not only ignoring the problem, but also actively allowing it to happen, the former Norfolkan said.

“We have to collect the corporate income tax that is due from our publicly traded corporations,” said Domina, an Omaha attorney who is the Democratic candidate in general election race to succeed Sen. Mike Johanns. “They get by with $1.3 trillion a year that we would collect if they just paid and didn’t have loopholes.”

Domina, in a visit to Norfolk on Tuesday night, talked about how major corporations are still acting on tax loopholes to relocate their corporate operations to other countries to avoid U.S. taxes.

“It ought to call it corporate desertion,” he said.

Domina is considered by some to be a throwback Progressive or Populist candidate from 100 years ago because of his stance against big business. He appears to relish the role of carrying the torch started by Nebraska lawmakers in the early 1900s.

He isn’t shy about his disdain for giving companies what he called “special” treatment, rules and tax breaks that don’t help small entrepreneurs and individuals.

He said paying off the national debt should involve everyone paying their share of taxes.

“We got here by making the mistake of bailing out the big banks instead of allowing the economy to work and allowing them to fail if they can’t manage themselves,” Domina said. “We should never repeat that mistake.”

As far as foreign policy, Domina said it also would be a mistake for the U.S. to leap into the war-like situation against Iraq and Syria Islamic extremists ISIS with no solid plan.

“We need to be very careful with the deployment of our military,” he said. “Now is the time for a lot of analysis.”

Please join us today! – Volunteer Here