The Budget & Tax Reform

The Budget & Tax Reform

I believe a timely budget must be passed, and the government must live within the budget. I believe debt held by foreign nations must be refinanced or repaid as quickly as possible so any Federal debt is held by the American people, and not foreign interests.

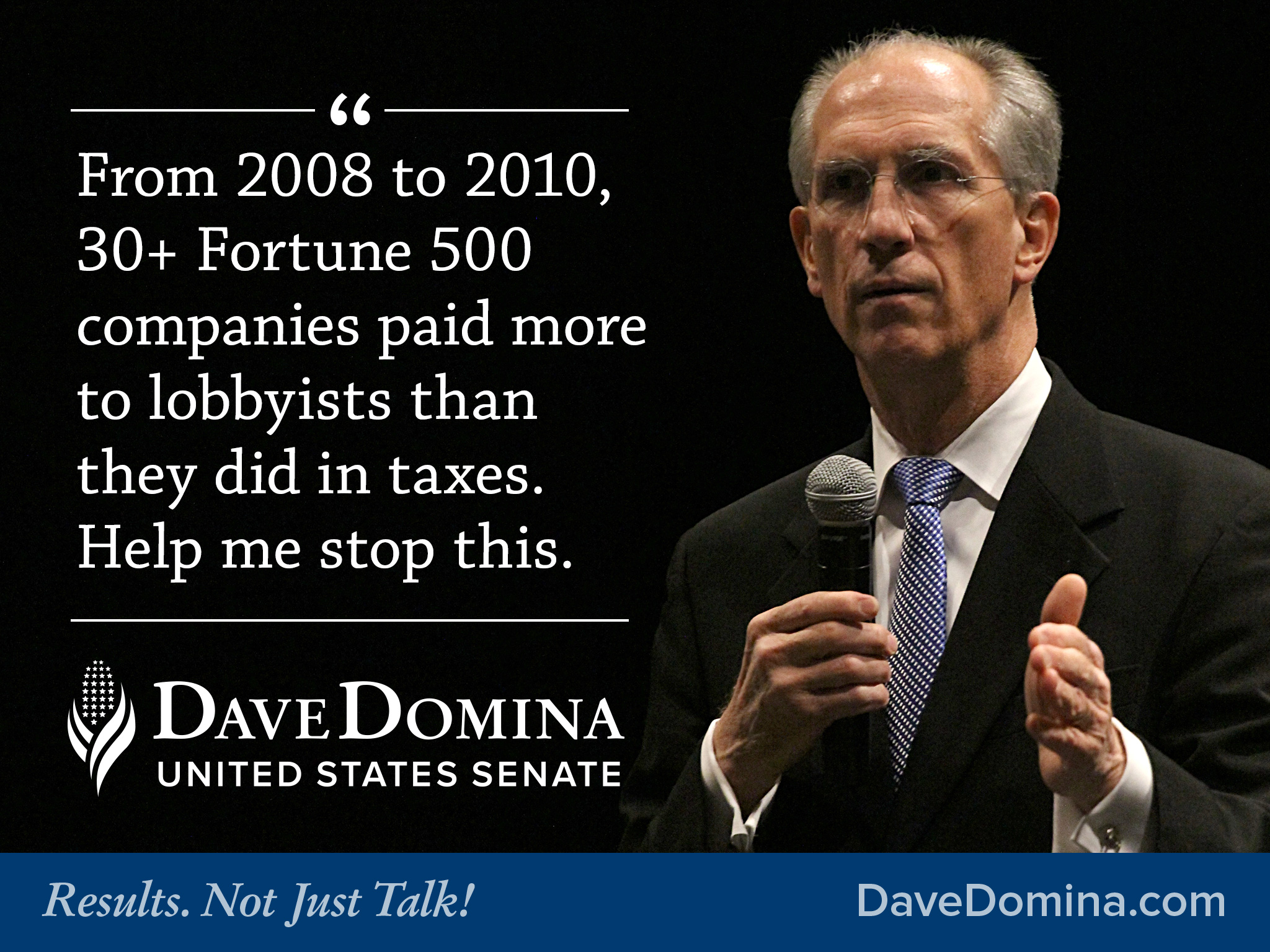

I believe the budget must be used to reduce the deficit as quickly as possible. This must be done by achieving tax fairness, which requires closing gaping tax loopholes. These loopholes allow major corporations to escape with no taxes at all, incentivizes them to expatriate jobs overseas, and, as a result, puts too much pressure on the middle-class. Yes, billionaires and huge corporations must pay their fair share.

I believe the middle-class must be the Nation’s priority. Its investment, reinvestment, and tax policies must assure equality of opportunity for all, and not be used to protect the wealthy to the detriment of the weak or poor, or the middle-class. This means a government that effectively spends taxpayer dollars as well as closes loopholes and tax advantages designed only for the ultra-wealthy and big business.

Our state’s most recently elected U.S. Senator signed the Grover Norquist Tax Pledge, which commits my opponent to a policy that will close no loopholes and assure that tax fairness is not achieved. This would leave the rich to prosper, put the burden on the middle-class and poor, and harm everyone who is not among the nation’s most elite wealthy people.

Because the billionaire class and multinational corporations have the ability to utilize and influence special tax loopholes created for them as well as spread money and capital across multiple countries, inevitably the tax burden in America falls on those who cannot pull these levers – the middle-class and small businesses.

When billionaires and huge corporations complain about taxes or fail to pay them at all – I remember those I served with in the Army. Most never made it back from Vietnam – those soldiers paid a “tax”, the ultimate tax, and so did their families. The annual rent I pay to use government goods and services isn’t a tax – it’s my privilege – and in exchange, I get to call myself an American.

Multinational Corporations & “Inversions” – Cheating on Taxes Against You

The Internal Revenue Code is too complex and has to be stripped of loopholes and special deals for huge corporations. It needs to be modified to prevent tax abuse through use of “inversions”. The Tax Code is riddled with exemptions, credits, and favors for huge companies with huge political PACs and big lobbying and election influencing budgets. Estimates are that these exemptions total $1.3 Trillion/year.

How much is $1.3 Trillion? Well, it is more than twice the total annual budget of the Defense Department.

Now, not satisfied they are getting by with enough favors, several huge companies have found a new scheme to avoid paying anything at all as taxes to cover the cost of the many government services they use. This new tactic is corporate “inversion”.

“Inversion” means a corporation moves its legal home, or legal citizenship to a tax haven country to avoid paying taxes in the country where it originated and conducts business. It chooses another country, often a tax haven like Cayman Islands, Barbados, or the Isle of Man, as its new corporate home, and continues in business in the United States but with lowered or eliminated income tax. The company remains a consumer of U.S. government services but no longer pays for them.

After an “inversion” the company cheats by avoiding its fair share of taxes. The company continues to use securities markets, federal safety laws, federal regulatory protections, public roads, schools, sewers, communications tools, and to enjoy the protections of U.S. courts, law enforcement, and the U.S. military’s might. But it does not pay for them; instead, that burden falls to the rest of us.

Can you think of anything more unethical than this kind of cheating? When it happens, each of us is cheated; we are forced to pay the cheater’s fair portion of the costs of quality government services. This is wrong on two levels: First, it treats corporations better than you or me. If we don’t pay our taxes we can go to prison. If these companies don’t pay because they buy politicians, they cheat all of us. They should be treated like felons, just like us!

These corporations have prospered because they have enjoyed the benefits of our democracy and our free enterprise economy. They did not succeed alone. We helped them. Already they have special favors, but they are greedy and want even more. They refuse to pay their fair share – they are unwilling to play by the rules you and I must follow.

I have been fighting against corporate greed and manipulation my entire career. Now, we need to be in this together. I need your vote and help to tackle Tax “Inversion” and let these companies know that if they leave, they will be hunted down and will find their world changed!